Understanding Category III AIF’s

Structured Investment Solutions – Category III AIF’s

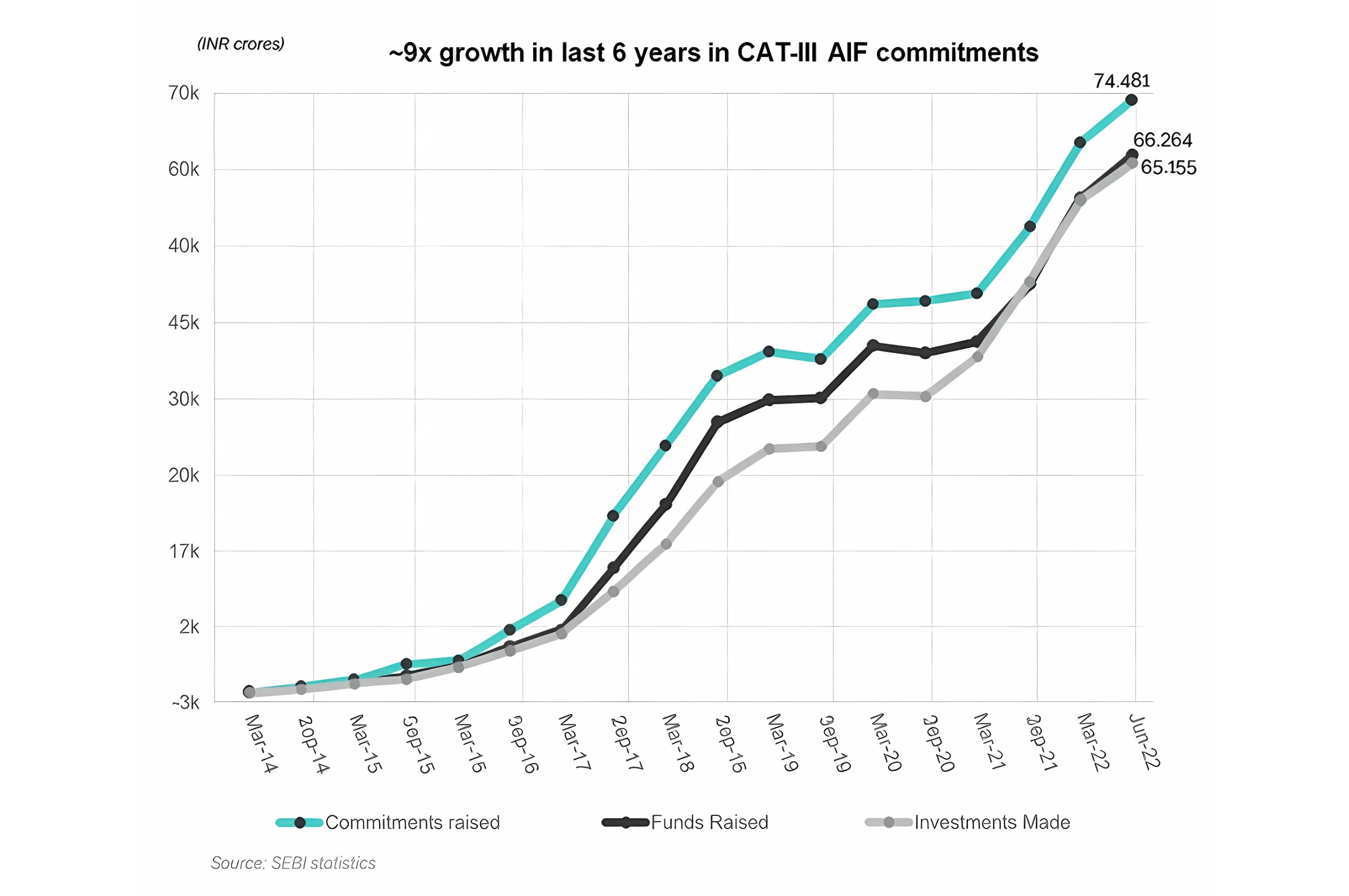

Rapid Growth

Commitments to Category III AIFs have increased about nine‑fold in the last six years (2014‑2022), reflecting strong investor interest.

Diversification Possibilities

Invest in wider asset classes including unlisted equity, debt, derivatives providing better risk management.

Upto 2X Leverage

Can be leveraged up to 2X for better risk adjusted returns.

Professional Management

Active investment decisions based on thorough business understanding.

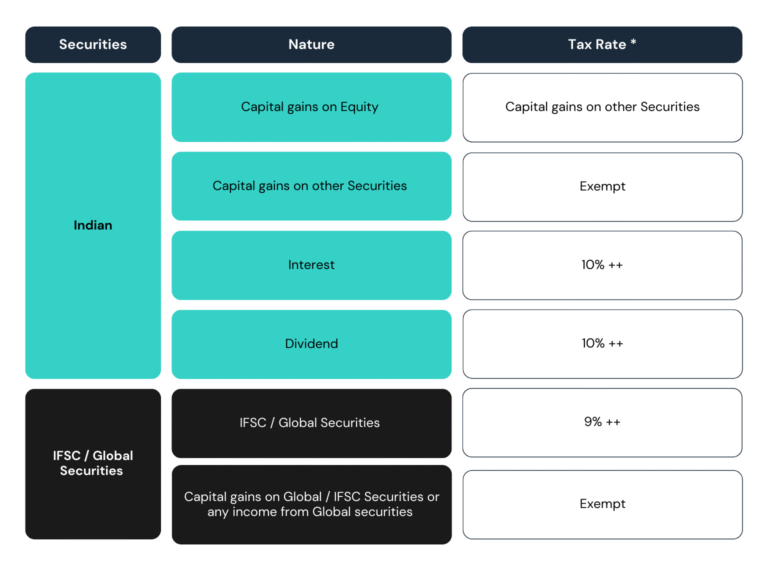

Tax implications.

Tax is assessed and paid at AIF Scheme level.

Better Governance

Comprehensive SEBI regulations, offering transparency and better investor protection.

International Financial Services Centre (‘IFSC’) & Gujarat International Finance Tech City (‘GIFT City’)

Global Benchmarking

At par with other global financial centres.

Integrated Development

62 Million Sqft of office, residential and social space.

Strong Promoters

Govt. of Gujarat initiative supported by Govt. of India.

Central Business Hub

High-Rise district with Vertical development.

India’s 1st

IFSC

India’s first operational IFSC notified by Gov. of India.

State of the Art Infrastructure

Next generation urban planning and ICT infrastructure.

Strategic Location

Between Ahmedabad and Gandhinagar with Airport Connectivity.

Ease of Doing Business

Conducive regulatory environment.

Unified Financial Regulator

Regulatory consolidation: The International Financial Services Centres Authority (IFSCA) regulates financial institutions, services and products within the IFSC.

Powers of multiple regulators: IFSCA is vested with powers from the RBI, SEBI, IRDAI and PFRDA and holds delegated authority under the SEZ Act, preventing dual regulation.

Fiscal Incentives at IFSC – GIFT City (Income‑Tax Holiday: 10 out of 15 years)

Stamp duty exemption

Exemption or reimbursement of stamp duty/registration fees, particularly on real‑estate transactions.

No GST

Output supplies or services rendered to offshore clients or other IFSC units are exempt from GST.

Tax exemptions for non‑residents

Exemption on specified securities traded on IFSC exchanges, non‑deliverable forwards with International Banking Units (IBUs), and interest on money lent.

Minimum Alternate Tax (MAT) @ 9 % ++:

No MAT when a domestic company opts for the concessional tax regime.

No customs duty

Goods imported into the IFSC from outside India are exempt from customs duty.

Dividend benefit

10%++ on Dividend payments to non‑resident by units in IFSC

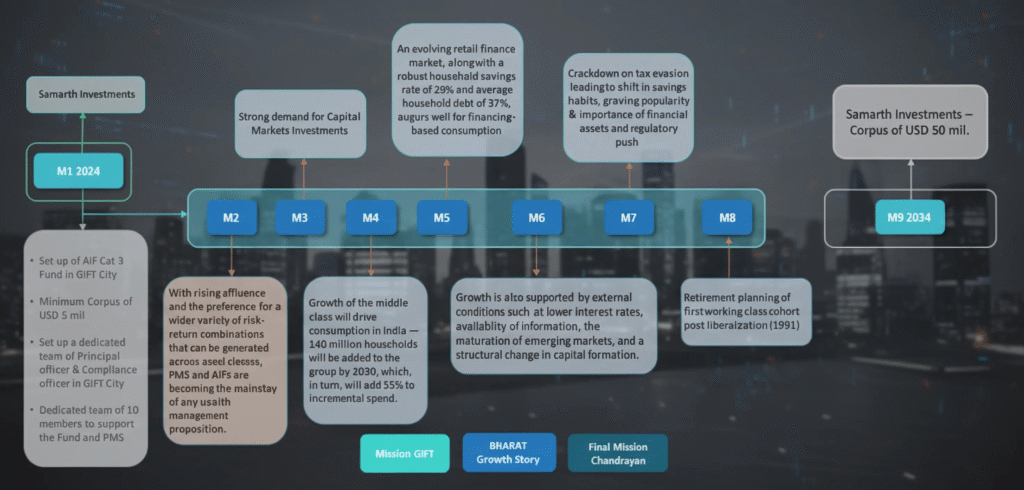

PMS & AIF Industry Growth Drivers (2024‑2034)

Indian families are increasingly moving towards financial savings and away from their entrenched habits of saving through gold and real estate. To the extent that Tier 2/3 towns were even more prone to saving through physical assets (gold, real estate), the financialization of savings and the growth on PMS assets is sharper….

Category III AIF in GIFT City

Indian families are increasingly moving towards financial savings and away from their entrenched habits of saving through gold and real estate. To the extent that Tier 2/3 towns were even more prone to saving through physical assets (gold, real estate), the financialization of savings and the growth on PMS assets is sharper….

- Cat III AIF set-up in GIFT City for undertaking diverse or complex trading strategies

- Proximity to onshore market – operational costs of Fund/ Manager in GIFT City will be relatively lower compared to, say Singapore

- Ability to invest in offshore and IFSC companies without requiring Indian regulatory approvals and in India vide Foreign Portfolio Investment (FPI) and/ or foreign direct investment (FDI) route

* Above tax incentives for Cat III AIF are to the extent of non-resident unitholder.

- Non-Resident Unitholders - Income earned is exempt. No requirement to obtain PAN or file Tax return

- FME eligible for 100% tax deduction for 10 years. GST savings on management fees