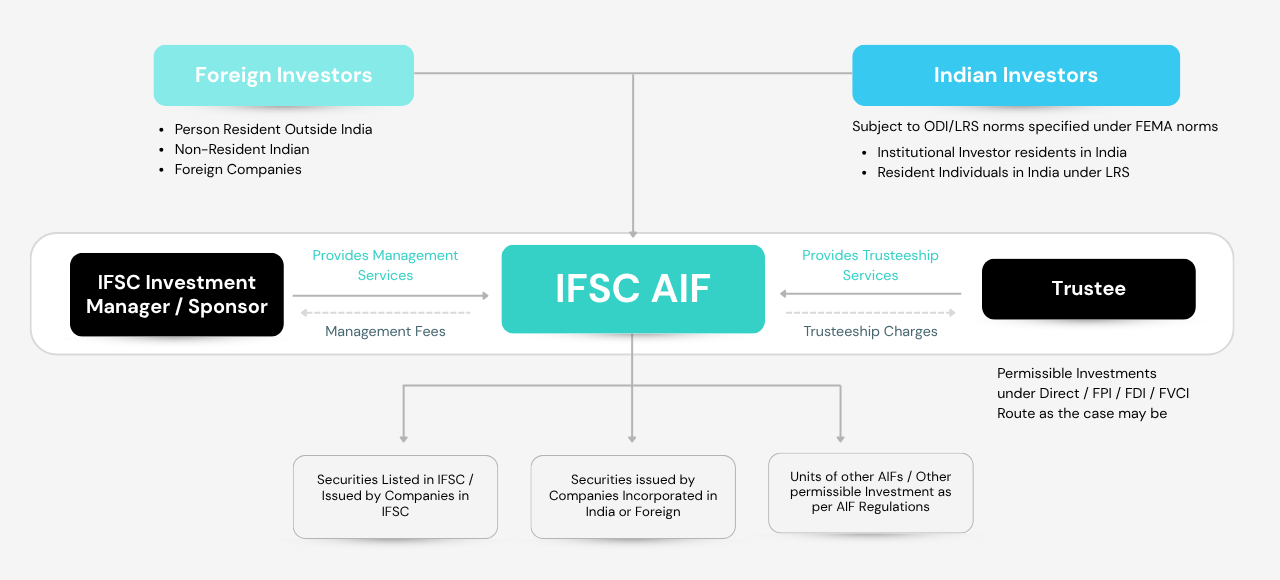

Typical AIF Structure in IFSC

Key Participants in an IFSC AIF Structure

Foreign Investors

Persons resident outside India, Non-Resident Indians (NRIs), and foreign companies.

Allowed to invest directly under FEMA-compliant routes.

Indian Investors

Institutional investors and resident individuals investing under Liberalised Remittance Scheme (LRS).

Subject to ODI/LRS norms under FEMA.

IFSC Investment Manager / Sponsor

Provides management and advisory services to the fund.

Earns management fees for fund administration and performance management.

AIF (Alternative Investment Fund)

The core investment vehicle pooling capital from investors.

Invests in securities or other permissible instruments as per SEBI (AIF) and IFSCA regulations.

Trustee

Provides fiduciary oversight and ensures compliance with regulations.

Receives trusteeship fees from the AIF.