Frequently Asked Questions

What is International Financial Service Centre (IFSC)?

An IFSC is a special jurisdiction from where global financial service providers offer financial services / products to global customers in foreign currencies.

In India, the role of an IFSC is to undertake financial services transactions that are currently carried on outside India by overseas financial institutions and overseas branches / subsidiaries of Indian financial institutions.

Gujarat International Finance Tec-City (GIFT City) is India’s only approved IFSC located in the city of Gandhinagar, Gujarat.

How is an IFSC regulated?

In India, an IFSC has to be approved by the Central Government under the Special Economic Zones (SEZ) Act, 2005 and is also governed by several Financial Services regulators such as Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI) and Insurance Regulatory and Development Authority (IRDAI)1.

The IFSC Authority Act, 2019 was enacted in 2019, to provide for an establishment of IFSC Authority to develop and regulate the financial services market in IFSC in India, which will replace the Financial Services regulators – SEBI, RBI and IRDAI. Recently, on 1 October 2020, the IFSC Authority assumed the powers over SEBI, RBI and IRDAI to develop and regulate the IFSC jurisdiction.

Who are the participants in an IFSC?

The participants in an IFSC are as follows:

What is the key difference between an IFSC unit and a domestic unit?

A unit set up in IFSC is treated as a “person resident outside India” (i.e. non-resident) for exchange control purposes whereas a domestic unit is treated as a “person resident in India”. Hence, an IFSC unit enjoys the privileges of a non-resident under exchange control provisions.

What does the IFSC mean to the global fund managers?

Global fund managers managing offshore funds, traditionally operate from offshore financial centres such as Singapore, Hong Kong, London, Ireland, etc., for making investments into Indian assets.

They have now started recognizing IFSC regime to make investments in India. IFSC has contributed to the growth of the entire Fund Management eco-system (Make in India for Fund Managers) including custodians, fund accountants, etc. in India.

How are the funds regulated in IFSC?

How does an AIF operate?

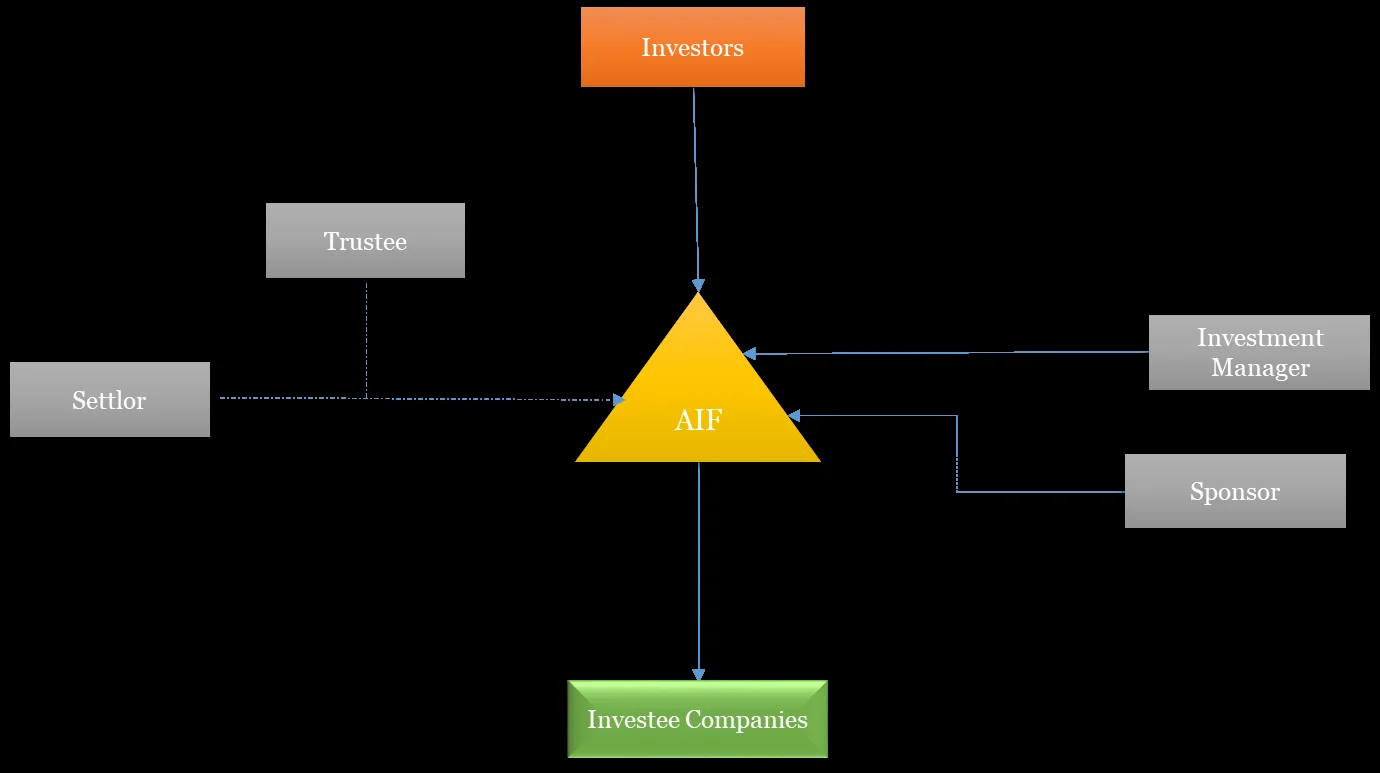

An AIF is an investment vehicle, set up in India, which privately pools funds / monies from domestic as well foreign investors and invests such funds / monies in securities as per a defined investment policy. In India, an AIF, along with its constituents, is regulated by the SEBI under the SEBI (AIF) Regulations, 2012 (SEBI AIF Regulations).

Operational structure of an AIF:

How can an AIF be set up in IFSC?

An AIF can be set up in the form of a trust, company, LLP or body corporate in the IFSC.

What are the different categories of AIFs permitted to be set up in IFSC? SEBI IFSC guidelines read along with the SEBI AIF regulations recognises the following types of AIFs:

(a) Category I AIF: Funds which invest in start-ups, early stage ventures, social ventures, small and medium enterprises,

infrastructure sector or areas which GoI consider as desirable.

(b) Category II AIF: Residual category i.e. other than Category I and III AIF and do not undertake leverage other than to meet day-to-day operational requirements as per SEBI AIF Regulations.

(c) Category III AIF: Funds which employ diverse or complex trading strategies and leverage including through investment in listed or unlisted securities / derivatives.

Who is a Sponsor of an AIF?

A Sponsor is a person who sets up an AIF (i.e. moots the idea of an AIF).

Who is a Manager of an AIF?

A Manager is a person who manages investments of the AIF in return for a management service fees. In many cases, the Manager entity also acts as the Sponsor entity for an AIF.

How can a Sponsor and/or Manager be set up in IFSC?

A first time Sponsor and/or Manager can be setup only as a company or limited liability partnership (LLP) in IFSC. However, if the person is already an existing Sponsor and/ or Manager to an AIF, such Sponsor and/or Manager is also permitted to set up a branch in IFSC.

What are the obligations of a Sponsor and / or Manager with respect to the AIF in IFSC?

The Manager or Sponsor is required to maintain a continuing investment interest in the AIF as follows:

• For Category I and II AIF: Lower of:

o 2.5% of corpus

o USD 750,000

• For Category III AIF: Lower of:

o 5% of corpus

o USD 1,500,000

However, any waiver of management fees will not be considered for the above purposes.

Who is permitted to invest in an AIF set up in IFSC?

Permissible investors in an AIF are as follows:

(a) a person resident outside India;

(b) a non-resident Indian;

(c) institutional investor resident in India eligible under exchange regulations to invest funds offshore – to the extent of outward investment permitted;

(d) person resident in India (having minimum net worth of USD 1 million during preceding financial year) eligible under FEMA to

invest funds offshore – to the extent allowed in Liberalize Remittance Scheme (LRS).

Can AIF in IFSC raise money in any foreign currency?

Yes, an AIF in IFSC can raise money in any foreign currency

What is the minimum investment size for an investor in an AIF?

The minimum investment by an investor in an AIF is as follows:

(a) For employees or directors of the AIF or its manager – USD 40,000;

(b) For other investors – USD 150,000

Where can the AIF deploy/invest its funds?

An AIF is permitted to invest in:

(a) Securities listed in IFSC;

(b) Securities issued by companies incorporated in IFSC;

(c) Securities issued by companies incorporated in India or foreign jurisdiction

(d) Units of an AIF

(e) Securities which a domestic AIF is permitted to invest in.

Can an AIF in IFSC invest in listed securities in India?

Yes. An AIF in IFSC can invest in listed securities in India under the Foreign Portfolio Investor (FPI) route. For this purpose, the AIF should also obtain an FPI license from SEBI under the SEBI (FPI) regulations, – 2019.

What are the investment routes available to an AIF investing in India?

AIFs in IFSC are permitted to invest in India under the following routes:

(a) Foreign portfolio investment (FPI) – AIF has to obtain FPI license under SEBI (FPI) regulations, 2019; or

(b) Foreign venture capital investment (FVCI) – AIF has to obtain FVCI license under SEBI (FVCI) regulations, 2000; or

(c) Foreign direct investment (FDI).

Taxation

Category III AIFs are subject to fund level taxation subject to the condition that all units of Category III AIF are held by non-residents other than units

held by its Sponsor / Manager.

1. The following income earned by the Category III AIF, which is attributable to non-resident investors in the AIF, is exempt from tax:

o Income on transfer of any securities (other than shares in a company resident in India), including derivatives, debt securities

and offshore securities.

o Income from securities issued by a non-resident (not being a Permanent Establishment)and where such income otherwise does

not accrue or arise in India

o Income from a securitisation trust chargeable under the head “profits and gains of business or profession

o Income on transfer of specified securities listed on a recognised stock exchange located in IFSC where consideration for such

transaction is in convertible foreign exchange

2. Income on transfer of shares in an Indian company is taxable as follows to the Category III AIF:

o Short-term Capital Gains – 20% if Securities Transaction Tax paid, else 30%;

o Long-term Capital Gains – 12.5%

• Income in respect of securities (such as interest, dividend) is taxable to the Category III AIF at the rate of 10% (5% in case of

interest income on certain rupee denominated bonds, Government securities or municipal debt securities referred to in section

194LD)

3. Any income accruing or arising to or received from the Category III AIF or on transfer of its units are exempt from tax in the hands of investors.

4.Surcharge on certain Long-term Capital Gains, Short-term Capital Gains and dividends earned by the Category III AIF is capped at 20%. Further, the

provisions of Alternate Minimum Tax are not applicable to the Category III AIF.

Are management and performance fees charged in GIFTY City subject to GST?

No, management and performance fees are not subject to the standard 18% GST applicable in other parts of India.

Can I invest funds from my NRE bank account in India?

Yes, since an NRE bank account in India is also considered equivalent to an offshore bank account.

Investment to be made in which currency?

USD Only

Will the fund issue K-1 forms to its US Investors?

Yes, the fund will obtain an EIN from the IRS soon, and thereafter, the fund shall also file Form 8832 with the IRS for the fund’s election as a pass through entity as per the US laws.

The purpose of this exercise is to enable the US investors to take credit for the taxes paid by the IFSC fund in India. As per our limited understanding, there are potentially two methods to take the tax credit in your US returns.

1) Claim credit against taxes due in the US; or

2) Reduce the income base.

**You may want to check with your tax advisor on the right method for your filing

What is LRS, TCS ?

LRS, TCS & Other Key Details:

1. Liberalised Remittance Scheme (LRS)

- Eligibility: Indian residents (including minors) with a valid PAN card

- Annual Limit: Up to $250,000 (~₹2.07 crore) per individual

For a family of four: $1 million (~₹8.3 crore)

2. TCS (Tax Collected at Source)

- No TCS: Up to ₹7 lakh remittances

- 20% TCS: On remittances above ₹7 lakh (except overseas education at 5%)

3. Double Taxation Avoidance Agreement (DTAA)

- Prevents double taxation for investments in the US

Taxation on US investments?

Taxation on US Investments

Capital Gains

• Short-Term (< 24 months): Taxed as per your income tax slab.

• Long-Term (> 24 months): Taxed at 12.5% without indexation (reduced from 20% after Budget 2024).

Dividend Tax

• 25% withholding tax in the US.

• Can be offset against Indian tax liability using the USD-INR exchange rate of the prior month.

Offsetting Capital Losses

• Short-Term Losses: Offset against short-term and long-term gains across asset classes.

• Long-Term Losses: Offset only against long-term gains.

______________

Are you a US Based NRI investing in Samarth Invest India?

Know the US Tax Impact and Alternative Investments. Choosing the right asset class and keeping the PFIC rules in mind is important for US investors.

We at Samarth Wealth Management have structured our own Onshore Delaware Based Feeder Fund for US Based Investors!

The fund has obtained an EIN from the IRS and has filed form 8832 with the IRS for the Master Fund, for the funds elections as a pass through entity as per the US Laws. The purpose of this exercise is to enable US investors to take credit for the taxes paid by the IFSC Fund in India. **You may want to check with your tax advisor on the right method for your filing**

US based investors must discern which investments fall under PFIC regulations to ensure compliance with US tax laws.

Unit based pooled investment funds like Mutual Funds are treated as PFICs (Passive Foreign Investment Companies) for US tax purposes

What is PFIC?

A PFIC (Passive foreign Investment Company) is a foreign corporation where either

a. 75% of its income is passive or

b. 50% of its assets generate passive income

Clarification of Indian Investment Options for US investors:

- PFIC : Mutual Funds, ETFs, REITS/INVITs

- Non – PFIC : Shares, Bonds and Debentures, Portfolio Management Services (PMS), AIFs issuing Form K1

- Securities held in AIFs (issuing form K1) are classified as Non-PFIC. US residents should consider switching from Indian Mutual Funds to AIFs issuing Form K1 to avoid PFIC Classification

- AIFs offer Lower US Tax complications, greater transparency, tailored strategies and NO PFIC Compliance.

PFIC Investments means filing annual form 8621 and making an election amongst the below alternatives:

1. Mark to Market Election

a. Annual unrealized gains taxed as ordinary income

b. On redemption, previously unrecognized gains taxed as capital gains

c. Losses can be offset against previous PFIC gains

2. Qualifying Electing Fund (QEF) Election

a. Taxed on your proportionate share of funds annual income

b. This method is not relevant since MF AMCs don’t provide QEF data